December Featured Title: Joy of Financial Planning

(Posted on Tuesday, December 17, 2019)

“We have a chance to transform our pessimism into optimism; our confusion into clarity, our passion into action; and our potential into real life success.”

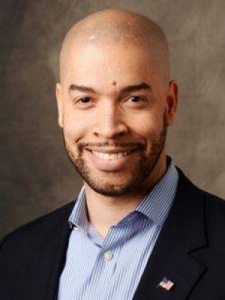

Our December featured title is Joy of Financial Planning by Jason Howell! We chatted with Jason about his extensive political and financial career, his involvement as an alumnus of George Mason University, and how we can reclaim our American Dreams through financial planning.

1. As President of the Jason Howell Company, a CERTIFIED FINANCIAL PLANNER™ professional, and a former U.S. Congressional candidate, you have a very extensive background in finance and politics. What inspired you to share your knowledge with American families through your new book, Joy of Financial Planning?

When I left politics, I became a financial planner so I could make a living while still serving the community. What I found over the years is that only so many people could choose to hire a true financial planner. Writing the book was a way to reach a larger audience who wanted (needed) the information, regardless of their ability to hire a professional.

2. In the preface of your book, you address the idealization of the “American Dream”, and how it has evolved over time as a result of inflation and other economic challenges. What does it mean for us as Gen X’ers and Millennials to reclaim our American Dreams?

It means we have a chance to transform our pessimism into optimism; our confusion into clarity, our passion into action; and our potential into real life success. This generation of adults has so much potential but we need the success principles of financial planning more than any other generation in US history. We face unique economic challenges but we also have unique opportunities. This is the generation that will face the effects of climate change, social unrest and income inequality. The “JOY of Financial Planning” allows us, through intentional actions, to solve problems and create opportunities for ourselves, our families and our communities.

3. You outline the steps that we can take to reclaim our American Dreams in seven distinct parts. Why did you choose to structure the book this way? What was your writing and researching process like?

I separated the book into seven distinct sections so people weren’t overwhelmed. In my family wealth practice, I have found that clients usually come to the table with a particular financial struggle that has their attention. Without that attention, they would have never picked up the phone and I wouldn’t have been able to show them all of their other opportunities. What I wanted readers of the book to be able to do was skip to what has their attention and discover the rest over time. My writing process was a mix of research, personal and professional experience. Unlike many of the other “personal finance gurus” I am still in practice as a CERTIFIED FINANCIAL PLANNER™ professional. This means I face real problems from real families and work to solve them in a current, practical way. And my personal financial situation is reflective of the dual-income professionals my firm tends to attract. Readers will enjoy that the book is a mix of academic, professional and personal content.

4. You are a very active alumnus of George Mason University, where you were recognized as a Prominent Patriot in business and was twice the distinguished alumnus speaker for the School of Business graduating class. During one of your keynote speeches, you notably said the following quote:

“Twenty-one years ago, somebody told me I was going to be an alumnus. I had no idea what that actually meant. I think it means you come back.”

Why do you feel it is so important to give back to your school, and to share your experiences and knowledge with aspiring businessmen and women?

George Mason University was good to me. My experience was more valuable and rich than I expected. I believe everyone of us has value to share and it’s not just a nice thing to do, it is necessary. Academic institutions require resources from the state, from the faculty, from the staff and from the alumni to remain relevant in an ever changing society. Northern Virginia is a great example of a thriving, changing society and “coming back” to Mason is my way of contributing to a community that I have benefited from for over 30 years.

5. What are the key takeaways from the book that you hope will help readers to take ownership of their financial joy and success?

I hope readers recognize that we can still achieve our potential and reclaim their version of the American Dream. And with that reassurance, I hope readers talk more regularly about money with their significant others, write down their personal values and aspirations, balance their priorities and make the best use of their time on earth. I bet you thought I’d say something like reduce debt right? Yes, that’s in the book but the takeaways listed here are just as important.

Get your copy of Joy of Financial Planning at the Amplify Bookstore.

To learn more about Jason, visit www.joyoffinancialplanning.com and www.Jason Howell.com, and follow him on Twitter, Facebook, LinkedIn, and Amazon.

620 Herndon Parkway, Suite 220|

Herndon, Virginia 20170

|

Phone: 703-437-3584|

Fax: 703-437-3554|

info@amplifypublishing.com

All rights reserved.